This year’s Financial Planning Week is focusing on helping young people plan their finances.

Mark Rantall, CEO of Financial Planning Association of Australia, said the goal for the week is to reach younger people through interactive technologies.

Financial Planning Week has answered 120 questions through the “Ask an FPA Expert” online forum and almost 100 people registering in webinars. The week wraps on Sunday.

“We’re just trying to highlight and elevate what financial planning is, and seek to demystify it – younger people think they mightn’t have enough money to get advice,” Rantall said.

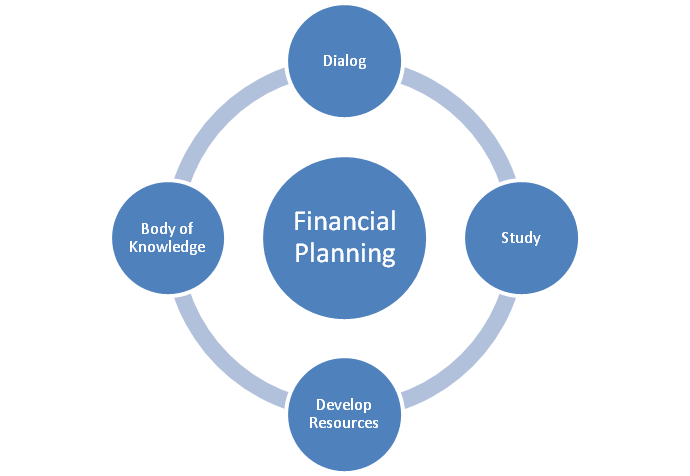

“A lot of financial planning is about increasing people’s financial literacy – just teaching them about money and how to use it.”

“What we say to younger people is, ‘Firstly, learn and understand about the positive power of money‘– making sure you manage whatever money you have in the most appropriate way.”

Rantall said having a high mobile phone debt is an example of younger people not managing their money properly.

To plan finances easily, Rantall recommends people picturing putting their money in three buckets: one for the long-term, one for the medium-term and one for the short-term.

Kevin Kelly, former RMIT lecturer in superannuation, told The City Journal the market isn’t looking after young people who want to organise themselves.

“The major benefit (of financial planning) is that it forces you to have a think about what you want to achieve,” Kelly said.

People should think about their financial plans from a “holistic” point of view, Kelly said. This includes what they want to achieve in the future.

“The benefits of having a plan is that you actually do it – you are far more likely to achieve it,” Kelly said.

Financial Planning Week is up and running! We are here to educate Australians about the value of financial planning! http://t.co/ZJBXtogymO

— FPA Australia (@AustraliaFPA) August 23, 2015

Both men said developments in new financial planning technology, including investment apps Acorns and FirstStep, are getting young people involved.

“Apps like that can be very attractive because they’re easy to use and can show you the value of doing things like (investing),” Kelly said.

Rantall said, “Technology does two important things – it provides knowledge … and provides access,” which help people to plan financially.”