“I’m not good with numbers” is one of the most common refrains when talking about great swaths of data. It can seem abstract and impenetrable. But more data is going to be produced in 2017 than in the previous 5000 years combined, so there is virtually no limit to the stories that can be told. The problem is how to present it in a way that is engaging to people who aren’t ‘data nerds’.

One of the most infamous data dumps in history was the NSA leak by Edward Snowden in 2013. Tens of thousands of highly classified documents were released containing metadata pertaining to international surveillance, most of illegal under US and international law. But how do you effectively communicate what was in these documents to the general public? One answer came in the form of an article by the Guardian titled NSA Files: Decoded, in which authors Ewen MacAskill and Gabriel Dance try to make the documents relatable.

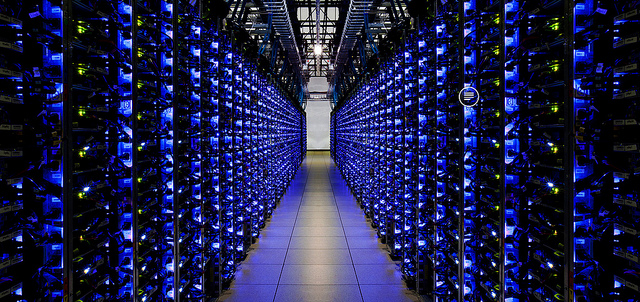

They consult various experts in related fields, such as former legal counsels to the NSA and US Senators. But as always, the key to successful data journalism is interactivity. This allows a reader to explore their own curiosity about what information can be gleaned from data sets. One such example is the slider a reader can use to see the extent of the ‘three hops’ rule employed by the NSA when analysing communications. Personally, my 3rd degree of friends encompasses 3 070 449 people. This helps to explain why the information size counter (another effective technique in communicating data) was able to reach 308 terabytes in the time it took me to get to the end of the page.

A less alarming, but nonetheless interesting, example of data journalism is the ABC’s Mortgage Stress Hotspots Revealed. Authors Inga Ting, Ri Liu and Nathanael Scott succeed in making extraordinarily complex sets of data easy to grasp by combining pleasing visuals (colourful balls are always welcome) with short but effective text. As with the Guardian’s NSA piece, interactivity takes on special importance, perhaps even more so. NSA surveillance can remain fairly abstract, given that very few of us have ever been detained or even investigated by intelligence authorities.

But mortgage stress is not just relatable, but painfully so for many people reading the article. Personally, I must admit I skipped straight to the end to see how my own suburb of Footscray (in which I co-own a mortgaged house) was faring. At 45% the chances of Footscray escaping inevitable rate rises unscathed is slim, as a rise of just 1% blow mortgage stressed households up to 60%.