Many Australians would agree that 2020 was not the best year, particularly for those located in Victoria. With lockdown after lockdown, and restriction after restriction, the COVID-19 pandemic has brought a lot of stress to people across the country, more recently hitting those in metropolitan and rural areas of Melbourne.

The COVID-19 pandemic has paved the way for what is known to be one of the lowest rent prices Australian tenants have ever seen. The Majority of renters across the nation have experienced their rent prices being paused by the Australian government, as a way to compensate for the lockdowns and restrictions.

On top of the rent prices, many tenants and renters in Victoria sought financial aid from the state government, such as the $500 million rent package and a $60 reduction from their weekly rent payments.

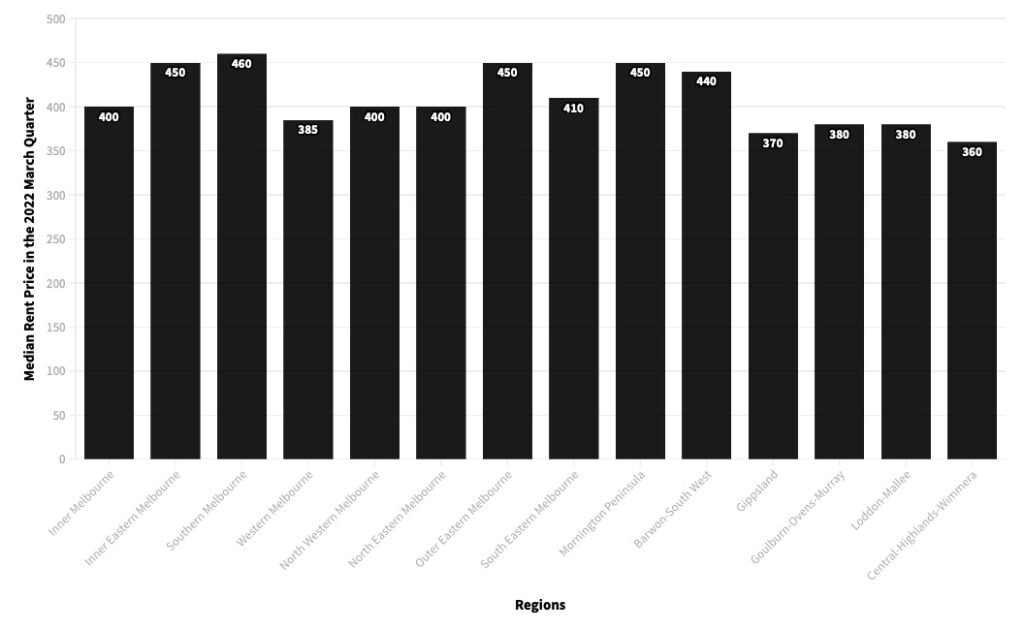

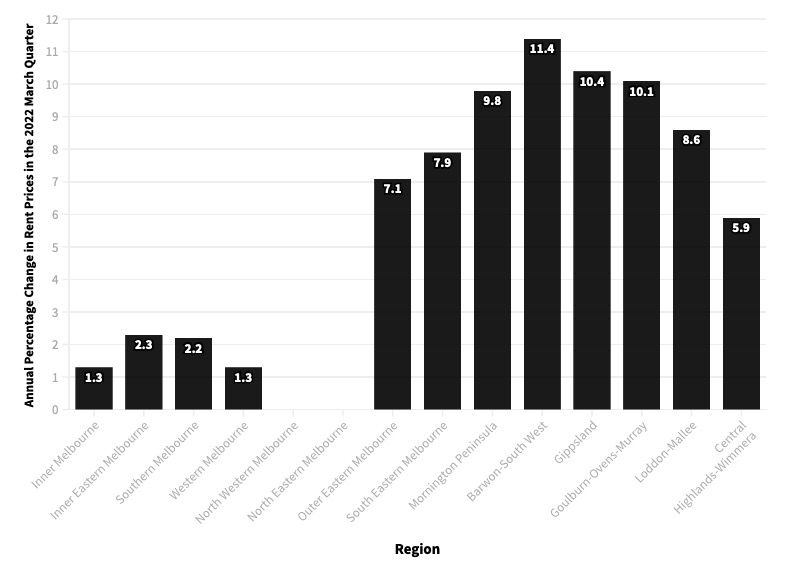

However, as of 2022, Victorian renters are experiencing an all-time high to their rent prices, with the rising interest rates to blame. As a result, families, couples and students in Victoria are living in great stress, as the price surge will threaten many renters out of their homes and apartments. According to the Victoria State Government Families, Fairness and Housing, renters in metropolitan Melbourne and regional Victoria are paying an extra $20 on average, as the Melbourne Rent Index has increased by 3.2 per cent during the last June quarter.

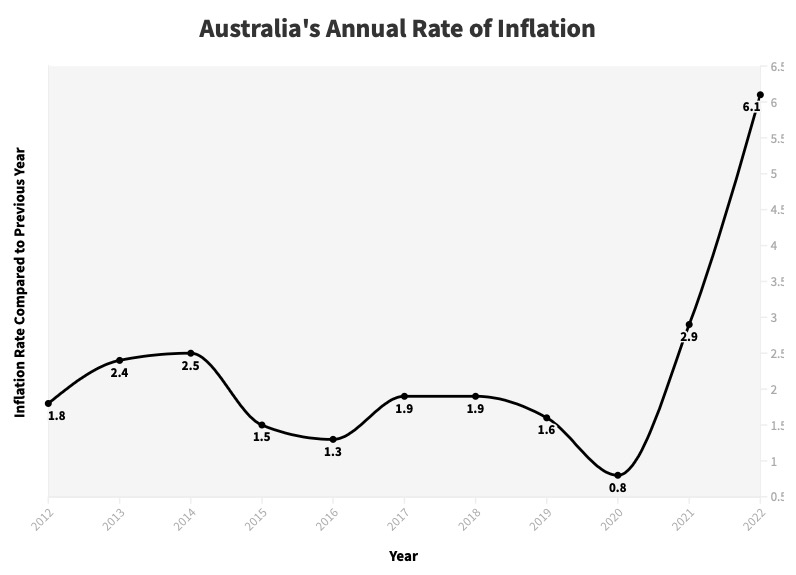

This has caused the nation’s inflation rate to rapidly increase, doubling more since December 2021, and is only expected to increase as the war in Ukraine continues into its ninth month.

With most Victorians feeling the pressure of the rent prices, many students and young renters are barely able to make ends meet to pay rent. Feeling the increase in rent prices is a university student and hospitality worker, Sam McCracken, who says that the impact of the rent prices has gone far beyond financial implications.

Working more than 40 hours a week to support himself, the full-time student is paying $1825 in rent every month for a 2-bedroom unit in Victoria’s South Eastern suburbs.

“You pretty much have to work full-time to afford to live, so I get pretty burnt out,” he said.

“I feel like I don’t have any time to properly take care of myself, so it’s safe to say my health is suffering as a result.”

Despite the roof caving in, the broken heating and cooling system, and the mould build-up in the bathroom, Sam’s landlord raised his rent by $100 per week in September.

“Paying rent is hard enough as is for a full-time university student, but with the increase in day-to-day living for groceries, fuel and transport, it’s pretty much unbearable,” he shares.

“I understand landlords have bills to pay too and they have to raise the rent as inflation rises but for tenants, it’s not feasible in the long run.

“It certainly isn’t for me.”

Due to the $100 increase, Sam had to make the decision to move back into his family home, saying that the “increase in rent was a major factor” in his decision.

“I’ve been out of home for two years now and I haven’t saved a single dollar,” Sam said, sharing that he feels like he is missing out on aspects of life due to not being able to save any money.

Although many Victorian students may not have the option to move back into their family home, Sam says he is immensely privileged to have a “plan b” to fall back on.

“Not everyone has a home to go back to if they desperately need [it], and so I consider myself very lucky. I would probably be couch surfing if this wasn’t an option,” he said.

Also feeling the effects of the rise in rent is outdoor education student and casual worker, Jarred Palanca, who has been “financially, emotionally and physically” impacted by the changes.

“It has caused me to be more aware of my financial decisions,” he said.

From juggling two jobs and completing his final year, the full-time student has had the weekly rent for his Bendigo home jump from $360 to over $400 in the last few months.

To be able to continue living in his three-person home, Jarred shared that he has had to make sacrifices which include dumpster diving at grocery stores in order to provide for himself.

In addition, the 22-year-old had to cancel the subscriptions to his Spotify and Netflix accounts, a “simple luxury” that is seen by many people.

“A few sacrifices were made in order to accommodate the increase in rent,” he said.

“Things as well as gas and electricity. We had to be a little more cautious in how we use it. And just being more aware of how much of those things we were using.”

But just like Sam, Jarred also “considered moving back” to his family home located in Melbourne’s west, as it would’ve made a big difference to his financial situation, he said.

Because of the location of his university, Jarred said that moving back to Melbourne “wasn’t really an option” since he would spend more money on petrol.

“I thought about moving back home cause it would’ve been a cheaper move. However due to university… it would’ve been just as expensive to travel back from Melbourne to Bendigo,” he shares.

As last month marked his third year in his shared home, Jarred reflects how renting during the COVID-19 pandemic was “easier” compared to this year, as he was able to receive financial support from the Victorian government.

“During the pandemic, the difference in price then to how it was before the inflation rates, was the same. However, I was able to get government assistance during the pandemic,” he said.

“So that essentially allowed me to have a little bit more help with paying my rent, compared to now where assistance is no longer there.

“And now I am having to continually pick up shifts at work.”

Yet without any government support this year, Jarred said he will “continue to be in the rental market” if prices were to increase in the future. However, just like the financial decisions he made this year, Jarred will need to cut down on more expenses in order to support himself in the next coming years.

“There’s not many options as a student or as an outdoor educator. So regardless, my options will still be renting,” he said.

“That would just mean having to cut down on expenses. Spending less money on holidays, spending less money on materialistic things, general goods, and other expenses in life.”

Although this rise has been a shock for many renters across Victoria, Melbourne’s CBD still remains the most affordable city to rent a house in Australia, according to Domain’s 2022 June rental report. Tenants in Canberra are paying $690 a week on average for housing compared to those in Melbourne who pay $460. This is a difference of $230 a week between the two cities.

However, the average net salary for those living in Melbourne’s CBD is approximately $283 less than tenants in Canberra, possibly evening out the playing fields in the rental crisis across Australia.

The rising cost of rent goes far beyond economics, for many Victorian tenants the financial toll has become a significant burden as it continues to impact their health, financial goals and much of their future planning.

For tenants like Sam and Jarred, an end to rising inflation rates and consequently the rise of rent prices, is desperately needed.

The rental increase has affected many student renters in Victoria, but what if this crisis extended to families across the state? To read more, click the story below by Nour Hegazy.

Writers and Editors: Cloey Nash, Tess McCracken and Mishelle Tongco

Editors: Cloey Nash, Tess McCracken, Mishelle Tongco, Christopher Healy

Graphs: Tess McCracken