By Rochelle Kirkham

Australian women are likely to retire with just over half the money of men, according to a report from the Australian Bureau of Statistics (ABS).

For many women, it’s a concerning thought. Some in their late 30s and 40s are anxious they will not have enough superannuation to fund their retirement, according to social research company Ipsos. Right now, there are women living their last years in poverty.

For 59 year old Anne*, the superannuation gender gap is a reality. Her superannuation balance is $80,000 less than her husband. She changed from full-time to part-time employment after having three children.

“I had a husband working full time and I was counting on his super for retirement,” Anne says.

“It is fortunate I have my husband’s super to fall back on now.”

Course Director in Financial Planning at Deakin University Dr Adrian Raftery says women retiring with less superannuation aren’t able to enjoy the same lifestyle as their male counterparts.

“If the average woman is earning a lot less than the average male, effectively the 9.5% superannuation going in each month is going to be lower,” he says.

49-year-old Rebecca* is a single parent with a mortgage and two children at school. She chose to dip into her retirement savings to pay insurance. The money for her income protection and life insurance comes from her superannuation balance.

“But my superannuation will be higher than a lot of other women,” Rebecca says.

“I’m a single parent but I have always maintained work as my mother helped look after the kids when they were young.”

Many women are facing financial insecurity in retirement according to ABS data.

Australian women have, on average, $70,000 less than men in their superannuation balance at 55 to 64 years of age, according to ABS statistics.

[infogram id=”aae5555e-746d-4581-bc33-2d48b57f593b”]The superannuation gender gap doesn’t appear to be closing any time soon.

Industry Super Australia Deputy Chief Executive Robbie Campo says projections show women will retire with, on average, 39% less than men in 30 years time.

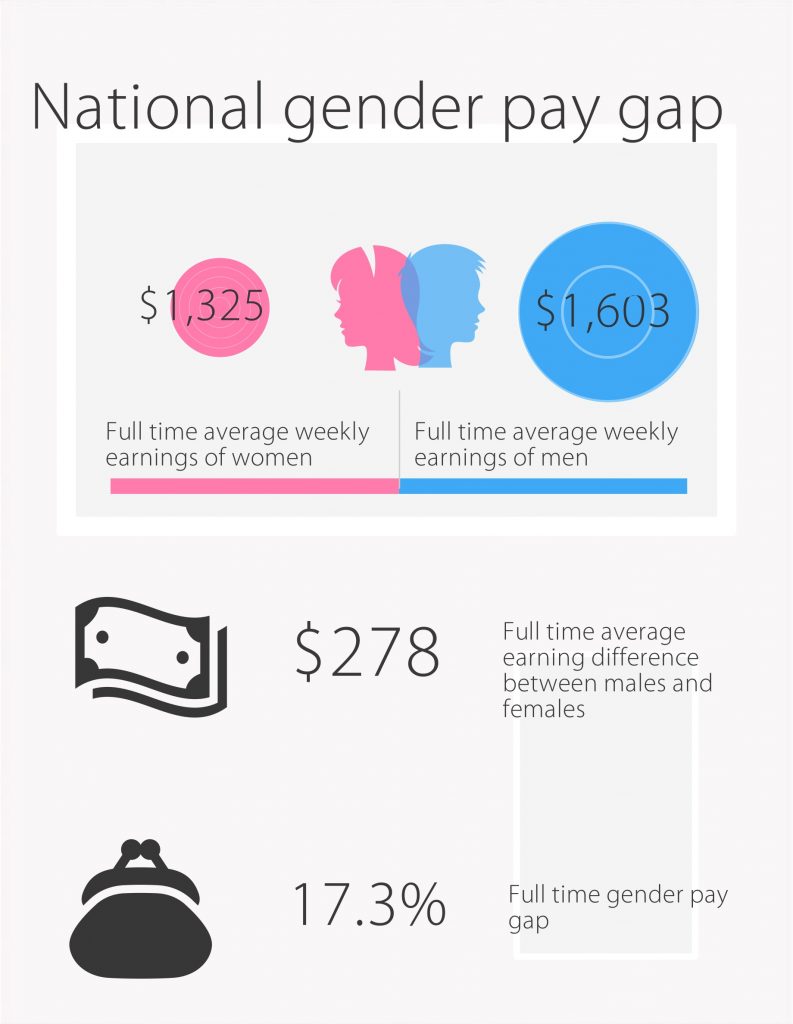

“Our gender pay gap has been stuck between 15% and 19% for two decades, so several generations of working women are already facing a significant disadvantage in their retirement savings,” she says.

[infogram id=”fb912fd4-6736-44a3-a12c-34e54bf4bd10″]Australian Super says economic insecurity in retirement for women is a result of structural inequalities in employment and workplace participation.

There are multiple factors contributing to the superannuation gap:

- On average women earn lower wages than men

- Women are more likely to have broken work patterns due to family responsibilities

- Women are more likely to work in occupations with lower pay than men

- A majority of part time and casual workers are women

- Fewer women hold senior executive and board level positions

- Women typically retire earlier and live longer than men

The average female is currently retiring with a superannuation balance only one fifth of what is required for a comfortable income in retirement, according to Australian Super.

Deakin University’s Dr Adrian Raftery says it’s concerning, but not unexpected many women are retiring with less superannuation than men.

“A lot of women are losing at least one quarter of their working lives looking after and raising families,” he says.

“Many are single when they retire, so they are not going to be able to rely on a male to support them during retirement.”

Women working full time earn 17.2 per cent less than men.

Industry Super’s Robbie Campo says the gender pay gap means lower superannuation contributions and poorer standards of retirement for women.

“The pay gap is entrenching an even bigger super gap for women,” Ms Campo says.

Adding to the gender gap, women are more likely to be employed part time and work fewer hours than men, meaning less money goes into their superannuation fund, ABS data shows.

44 per cent of employed women worked part time in 2015-16, compared with 15 per cent of employed men.

[infogram id=”70fa7fc4-c8a0-47b0-9552-dcbc2dfaa3b6″] [infogram id=”2c8dda62-ae20-4e10-ad3c-5f5b22863a89″]Single women on low incomes are most at risk of struggling financially in retirement.

Deakin University’s Adrian Raftery says retired women with low superannuation balances are forced to look at liquidating other assets like the family home.

“Then they turn to the age pension,” he says.

27% of women aged 55 to 64 have no superannuation compared to 17% of men.

[infogram id=”851a53f7-9a49-457a-8029-f8a4741700ba”]“In a wealthy country like Australia, no woman who has spent her life working and caring for others should have to retire in poverty,” says Industry Super’s Robbie Campo.

But it is not only women retiring struggling financially in retirement. 17% of men will retire with no super.

[infogram id=”2e89e86c-fbc5-4dde-94f3-ec680b729dab”]An increasing number of women are relying on the age pension. Industry Super’s Robbie Campo says current settings around retirement income policy are failing to address the superannuation gap.

She says a key priority is to reinstate the superannuation tax rebate for low income earners, which would affect half of all working women.

* Not her real name